Finally, contextual customer insights without manual coding

In highly-regulated, competitive environments, financial services must rely on actionable insights to understand key drivers of customer spend and loyalty and improve advocacy.

Plug the text analytics gap that CX platforms leave to drive satisfaction and loyalty

Transform your customer’s experience online or in-branch with actionable insights uncovered using a next-gen insights tool.

Uncover key drivers of satisfaction and loyalty

Remove the need for manual coding and improve the quality of insights from CX platforms like Medallia, InMoment, and Qualtrics.

Get the deep customer context you need

Understand the context behind basic categories like "fees" or "policy" to pinpoint exactly what about these topics your customers care about.

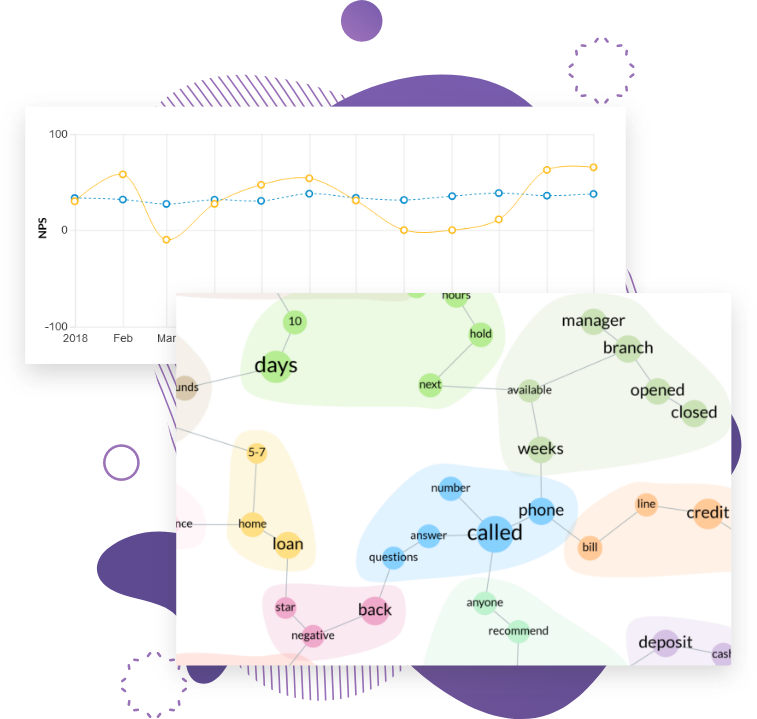

Spot emergent trends quickly and easily

Use unsupervised machine learning to spot the unknown unknowns, before they impact your CX and eventually, your bottom line.

Eliminate time setting up and training

Analyze new data sets without any manual setup or ongoing model training and get answers to critical business questions.

Quantify the exact impact issues are having

Identify exactly what drivers are impacting your CX metrics and understand how fixing these will improve your CX scores and boost revenue.

Combine data sources for even richer insights

Uncover deep, actionable insights across multiple data sources including NPS, CSAT, reviews, social, complaints, and contact centre.

“The speed to value of Kapiche is far superior to anything I have seen in the market, with our team seeing results in days vs. weeks and months. ”

Head of Research and Insights, Big 4 Australian Bank

Watch a banking demo

We analyzed 1,056 NPS surveys for a bank in 1 minute and 11 seconds. This is what we found.